Ethereum 2.0: Outlook and Predictions for 2020

Introduction

When we talk about Ethereum, the first thing that comes to mind is decentralized applications, or DApps, where Ethereum is one of the most popular launching pad. For the uninitiated, Ethereum is an open software platform that allows developers to build blockchain applications via execution of scripts, or codes.

As we all know, Ethereum made the term “smart contracts”- essentially a self-operating computer program running on blockchain that automatically enforces a contract once it fulfils specific conditions – popular. Ethereum’s core innovation, called Ethereum Virtual Machine (EVM) has made the process of building decentralized application easier and more efficient for developers.

Ether, which is used as gas within Ethereum is the second biggest cryptocurrency by market capital. The current value of an Ether is approximately $183 and its market capital is valued at almost $20 billion.

Issues with Ethereum

As with most cryptocurrencies or blockchain applications, one of the main issues is scalability and Ethereum is not an exception. While the current Ethereum protocol is considered successful among its peers, it is still exposed to a number of major issues.

Ethereum is able to process roughly around 25 transactions per second, which is considered better than Bitcoin’s 7 transactions per second. However, it is still far behind other mainstream payment processors. Visa is capable of processing 24,000 transactions per second, Paypal’s maximum capacity is nearly 200 transactions per second, and even Venmo can process more than 100 transactions per second. Clearly Ethereum has a long way to go before it can become mainstream.

Two other major issues Ethereum has is demand for bigger storage as well as better performance. A few days ago, Ethereum’s co-founder VItalik Buterin issued a warning that Ethereum’s network utilization has reached 90% of its capacity. Previously, Ethereum’s network was bogged down with the launch of the decentralized game CryptoKitties and thousands of initial coin offerings that eventually turned out to be scams.

As a result of that, transaction costs also increased, and as space within Ethereum reduces and network slowed, other developers fled in search of greener pastures, so to speak. Even worse, corporate users and CIOs are now hesitant to flock Ethereum.

Ethereum 2.0

Since its inception, the development of the Ethereum platform was planned in four phases. On the 30th July 2015, the first stage of its development, “Frontier” was released. And almost a year later, a stable version of the second phase, “Homestead” was launched.

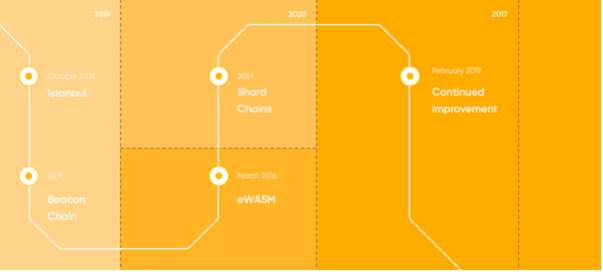

The “Metropolis” phase was divided into two updates, the Byzantium hard fork that occurred on the 16th of October 2017 and the long-awaited first part of Constantinople phase, Petersburg was executed on the 28th February 2019. The next part of the phase, Istanbul, is expected to activate any time soon.

The third phase brings with it some of the most important changes to Ethereum: the transition from the current Proof of Work (PoW) consensus mechanism to Proof of Stake (PoS), the introduction of zk-SNARKS, the much needed delay of the “time bomb” as well as smart contract upgrades.

The Constantinople upgrade, which is also called Ethereum 2.0, will eventually scale the network and eliminate other major issues on the road to Serenity, Ethereum’s final and complete phase. Included in the upgrade are 5 main EIPs (Ethereum Improvement Proposal):

#1. EIP 145: Introducing bitwise shifting, as EVM optimization codes, which is a more efficient way of coding that can reduce the cost of gas and number of instructions required.

#2. EIP 1052: Optimization of large scale code execution.

#3. EIP 1283: This is based on EIP 1087 and introduces a pricing method for storage to developers.

#4. EIP 1014: This is Vitalik Buterin’s upgrade proposal for a scaling solution that is based on state channels and “off-chain” transactions.

#5. EIP 1234: Decreasing the block mining reward from 3 ETH down to 2 ETH. This will also delay the “difficulty bomb” for 12 months.

According to Ethereum developers, the Constantinople upgrade will ensure that the network readies itself for Casper, that will initiate the final rollout of Ethereum 2.0 and activate the next phase, Beacon Chain in early 2020. A fully deployed Ethereum 2.0 will feature “sharding”, that will split the network load into independent groups called shards and allow Ethereum to scale. Besides that, EVM will be replaced with eWASM or “Ethereum Flavoured WebAssembly” that will enhance the speed of code execution in smart contracts. And of course, we shouldn’t forget the benefits brought by the deployment of PoS protocol as well as upgrades in the current “off-chain” solutions that will surely bring more investors into Ethereum.

Ethereum’s Price: Past, Present and Future

As always, it is difficult to assess the price movement of major cryptocurrencies. The uncertainty surrounding hard forks affects the price of cryptocurrencies, and more than that, it is almost impossible to predict the success of a project from its initial launch.

The Ethereum ICO introduced 1 ETH at $0.31, and the current value at almost $200 indicates a massive ROI (around 20,000%) of investing in Ethereum. Its ICO raised over $18 million within 42 days, a figure that held the highest record at that time and turned a lot of eyes towards the cryptocurrency industry.

Ether reached its highest point during the bull run in 2017, and recorded an all-time high of $1377 on the 16th January 2018 before plunging down with the rest of the cryptocurrencies. By April, Ethereum had lost over 72% of its value to sit around $384, and until today, its price recovery has been slow-going.

With the upcoming upgrades, and more excitingly as Decentralized Finance (DeFi) applications gain traction, there have been talks that institutional investors can potentially bring a boost to the Ethereum ecosystem. The increasing demand for Ether’s utility in gas fees, staking, and storage fees is also contributing towards optimistic evaluation of Ethereum’s price in the market.

What do the Experts Say?

While the rest of the crypto industry is waiting for Ethereum’s next upgrade with bated breaths, experts from all over the space have contributed their two cents. Vitalik Buterin, at the heart of Ethereum’s development had this to say:

“A lot of progress happened in the last one and a half months, we’re basically hurdling full speed ahead to having a public test network, which is the last major milestone before we can have on the network.”

According to Vitalik, progress towards ETH 2.0 is very active and Phase One of the upgrade is continually worked on – eventually, the ecosystem will be more secure, more powerful and most importantly, scalable.

Joseph Raczynski, founder of JoeTechnologist.com predicts that Ethereum will reach $1,000 by the end of the year. “They (Ethereum) are one of the most real projects to date,” Raczynski said. “Nearly all large organizations are testing on this platform.”

Joseph Raczynski, founder of JoeTechnologist.com predicts that Ethereum will reach $1,000 by the end of the year. “They (Ethereum) are one of the most real projects to date,” Raczynski said. “Nearly all large organizations are testing on this platform.”

Raczynski’s prediction is considered more conservative than his peers. Steven Nerayoff, Ethereum’s co-founder expects Ethereum to achieve $3,000, a figure doubling its record all-time high. His very optimistic prediction is based on what he says is “an exponential increase in the number of projects, where billions of dollars are being poured into the ecosystem, and this could lead to a doubling, probably tripling in price by the end of the year.”

Clem Chambers, the CEO of investment website ADVFN predicts the future price of Ethereum to be closer to Raczynski’s ballpark. According to Chambers, “though the past doesn’t predict the future, Ethereum and Litecoin are cryptocurrencies to watch for to start rallying as a potential signal for the crypto market bottom we are all waiting.”

Buying Ethereum

There seems to be altogether an optimistic outlook towards Ethereum, especially considering the promised upgrades and major milestones in Q4 2019 and Q1 2020. In addition to that, the sentiment of the whole cryptocurrency market regarding the new bull season is supporting the upward trend in the long term.

Are you ooking to invest and stack some Ethereums into your reserves? Being the second largest cryptocurrency in the market, buying Ethereum cannot be easier. Most exchanges offer fiat-to-ETH as well as major crypto-to-ETH pairs for your purchasing convenience.

And if you’re planning to buy Ethereum in Malaysia, here is a simple guide for you: How to Buy Ethereum in Malaysia. If you’re a first-time user at Remitano, this article provides a step-by-step guide from registering at Remitano to purchasing Ethereum.

Conclusion

Buterin concluded in his press conference at DevCon 5 held in Osaka, Japan recently, “Our ideas are tomorrow’s demos and our demos are tomorrow’s reality.” And this resonates throughout Ethereum’s community reflected in its anticipation of the next major upgrades. Time will tell whether Ethereum 2.0 will be the answer to all Ethereum’s shortcomings, or perhaps other blockchain protocols might be a better market fit in the future.